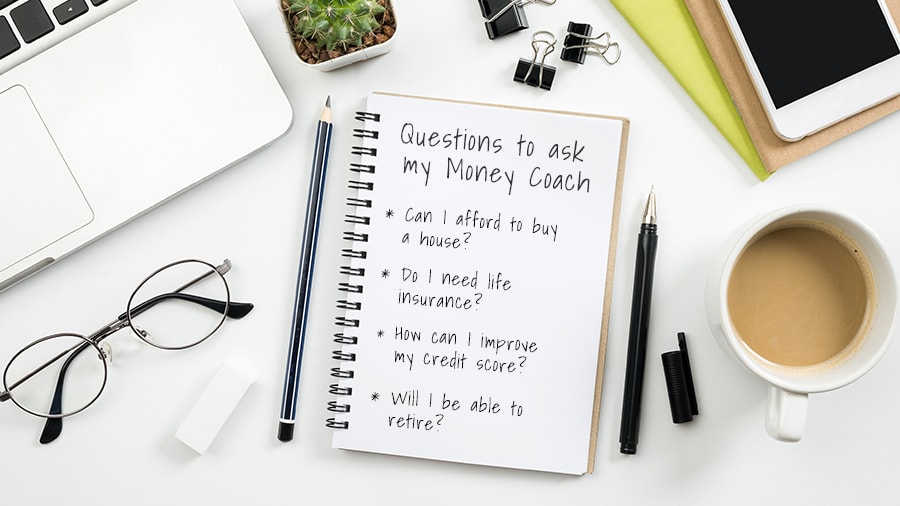

Top 10 Money Coaching Questions

Whether you’re new to working with a Money Coach or a veteran who knows the perks of having a money mentor, perhaps the questions below can make their way into your next call with a Money Coach.

Whether you’re new to working with a Money Coach or a veteran who knows the perks of having a money mentor, perhaps the questions below can make their way into your next call with a Money Coach.

In no particular order, here is our list of the top ten financial questions we get asked, plus a bonus question that’s currently trending in popularity:

#1 Benefits & Open Enrollment

Should I keep my HMO medical plan or consider a health savings account and a high deductible plan? What’s the difference?

#2 Home & Mortgage

Can I afford to buy a house?

#3 Credit & Debt

What is the best way to pay off credit card debt?

#4 Savings

How can I get started with saving money?

#5 Savings

How much emergency savings is enough?

#6 Investing

Should I try to pay off my mortgage early or save more for retirement?

#7 Home & Mortgage

Is it a good time for me to refinance?

#8 Budgeting

I’ve tried budgeting, but it hasn’t worked out – can you help me get organized?

#9 Insurance

Do I need life insurance? How much? Which kind is best?

#10 Retirement

Will I be able to retire when I want to? How do I know?

BONUS

Is there anything I can do to pay less in taxes?

Have you been wondering about any of these things? Have another money question on your mind? Your Money Coach is happy to help. If you haven’t worked with a coach before, it’s easy to get started. You’ll be glad you did.

More Like This

In this Trending Topics segment, Money Coaches discuss how you might prepare your finances if business and economic growth slow down. They’ll also talk about how you might manage your emotions and your actions when investment markets are volatile.

Want to be a smart shopper and spend less? Master these tips and you could be saving money in no time. Make a spending plan. Ultimately, you shouldn’t spend money unless it’s in the budget, so buy all necessary purchases before you think about getting any luxury items. Online shopping. Research multiple retailers’ pricing, product […]

Outliving your money is a scary thought. That’s why a top goal in retirement planning is making sure your money lasts as long as you do. Assessing your retirement income is the first and most common way to start. But going over your investments, retirement accounts and other income sources is just the beginning to […]

The My Secure Advantage Financial Wellness program (MSA) strives to help people improve the one thing that affects practically every part of life – finances. Here are the top five reasons why using MSA can be one of the best decisions you ever make. 1. Your health depends on it. One of the top stressors […]